Reports

Lead Manufacturing Plant Project Report 2025: Market by Region, Market by Application, Key Players, Pre-feasibility, Capital Investment Costs, Production Cost Analysis, Expenditure Projections, Return on Investment (ROI), Economic Feasibility, CAPEX, OPEX, Plant Machinery Cost

Lead Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

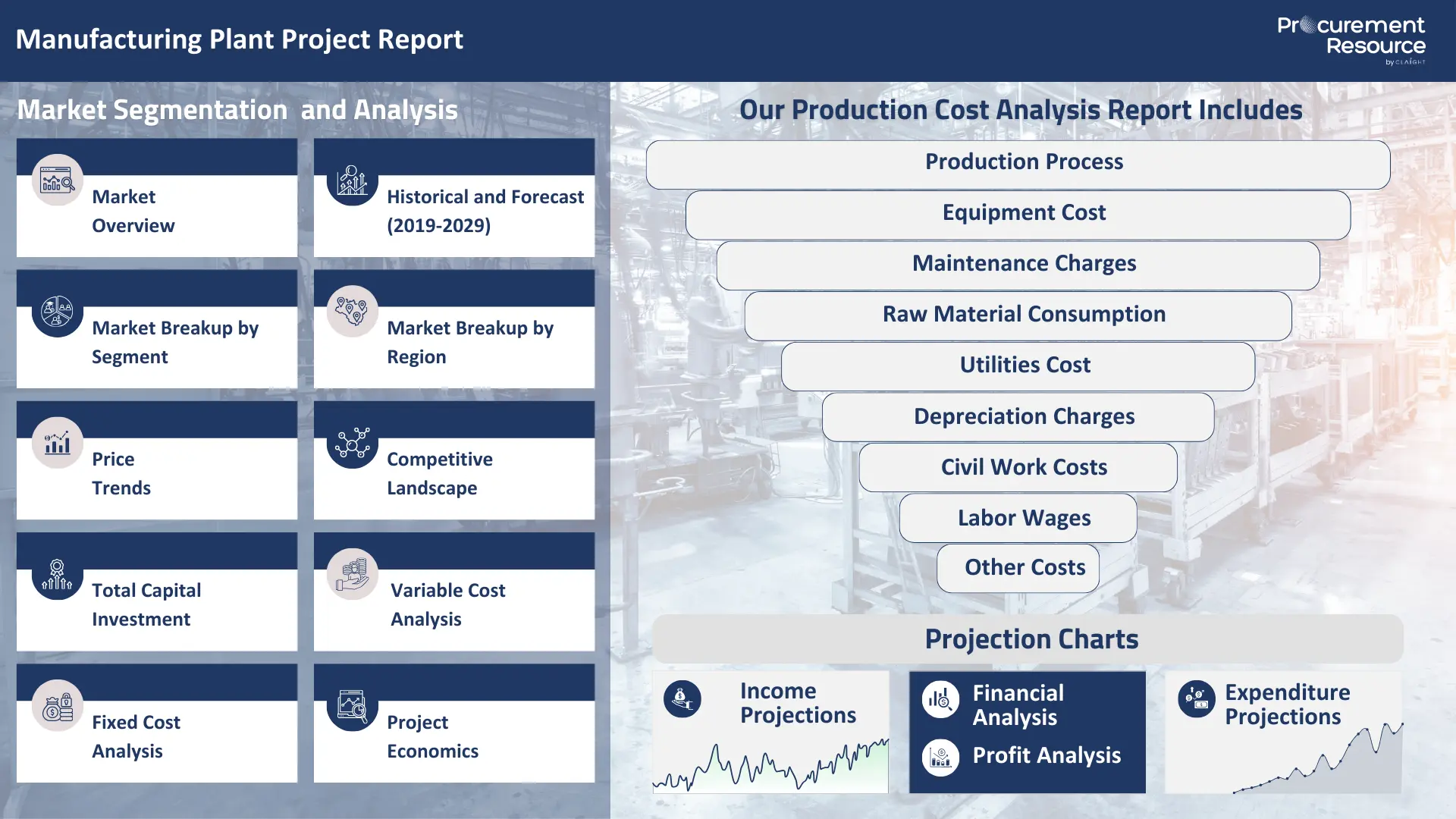

Lead Manufacturing Plant Project Report by Procurement Resource thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down Lead plant capital cost around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimisation and helps in identifying effective strategies to reduce the overall Lead manufacturing plant cost and the cash cost of manufacturing.

Planning to Set Up a Lead Plant? Request a Free Sample Project Report Now!

Lead (Pb) is a heavy, soft, and malleable post-transition metal with the atomic number 82. It is a dense and corrosion-resistant material, which makes it significant in construction, plumbing, and manufacturing. When freshly cut, it exhibits a bluish-white lustre that quickly tarnishes to a dull grey upon exposure to air. While its use has been curtailed in many applications due to its toxicity, lead remains a critical industrial commodity, primarily for its role in energy storage.

Applications of Lead

- Lead-Acid Batteries (80-85%): Lead is the primary component in starting, lighting, and ignition (SLI) batteries for conventional and electric vehicles, as well as in industrial batteries for backup power systems (UPS) in data centres, telecommunications, and for motive power (e.g., forklifts).

- Rolled and Extruded Products (5-8%): Due to its high density and malleability, lead is rolled into sheets for roofing, cladding, and as a barrier for radiation shielding in medical X-ray facilities and nuclear power plants.

- Pigments and Chemicals (3-5%): Lead oxides are used in the manufacturing of specialised glass (e.g., CRT glass) and ceramics. Other lead compounds serve as chemical intermediates, though their use as pigments in paint has been phased out in most countries.

- Ammunition (2-4%): Lead is the primary material for manufacturing bullets and shotgun pellets due to its high density and low cost.

- Alloys and Other Uses (1-2%): This includes use in solders, bearing alloys, and weights for various balancing applications.

Top 5 Manufacturers of Lead

Lead production is managed by large, global mining and metallurgical companies. A significant portion of global production also comes from secondary refining (recycling).

- Glencore (Switzerland, Global)

- Teck Resources (Canada, Global)

- Hindustan Zinc (India)

- Korea Zinc Company (South Korea, Global)

- Yuguang Gold and Lead (China)

Feedstock for Lead and Value Chain Dynamics

The lead value chain is unique, with a strong reliance on both primary (mined) and secondary (recycled) feedstocks.

- Primary Ore Sourcing:

- The primary feedstock is mined lead ore, most commonly Galena (lead sulfide, PbS). This ore is often found and mined in conjunction with other valuable metals like zinc, silver, and copper.

- Co-Product Economics: The economic viability of a lead mine is frequently dependent on the market prices of its co-products (especially zinc and silver). This creates a complex pricing dynamic.

- Secondary Feedstock Sourcing (Recycling):

- A major portion of global lead production (over 50% globally, and over 80% in regions like the US and Europe) comes from recycling spent lead-acid batteries.

- Circular Economy: This creates a highly efficient circular economy, reduces the environmental impact of mining, and provides a stable feedstock source that is less volatile than primary ore exploration and development.

- Coke and Energy Sourcing:

- The smelting process is highly energy-intensive and relies on metallurgical coke as both a fuel source and a chemical reducing agent in the blast furnace.

- Energy Price Sensitivity: The cost of lead is directly impacted by fluctuations in global electricity and coke prices, which are major components of the operating expenses (OPEX).

- Flux and Reagent Sourcing:

- The process requires large quantities of fluxes (like limestone and silica) to help separate impurities in the furnace. The initial flotation stage also requires specialised chemical reagents. The cost and logistics of these materials are key factors in the production cost analysis.

- The process requires large quantities of fluxes (like limestone and silica) to help separate impurities in the furnace. The initial flotation stage also requires specialised chemical reagents. The cost and logistics of these materials are key factors in the production cost analysis.

Market Drivers for Lead

- Automotive and Transportation Growth: The global vehicle fleet continues to grow, driving demand for SLI batteries. Even electric vehicles rely on 12V lead-acid batteries to power auxiliary systems, which elevates the demand for lead.

- Demand for Uninterruptible Power Supplies (UPS): The expansion of data centres, 5G telecommunication networks, and renewable energy storage systems fuels the demand for industrial lead-acid batteries for reliable backup power.

- Efficient Recycling Infrastructure: The well-established and economically viable battery recycling loop makes lead a sustainable choice for its primary application, helping it maintain market share against competing battery chemistries.

- Regional Production and Consumption Patterns

- Asia-Pacific (APAC): China is the world's largest producer, refiner, and consumer of lead. Its massive industrial and automotive sectors drive global demand. India and other Southeast Asian countries are also growing consumers.

- North America and Europe: These are mature markets with high consumption but an overwhelming reliance on secondary (recycled) lead production. They have stringent environmental regulations that govern the operation of smelters and require significant capital investment (CAPEX) in pollution control technologies.

CAPEX (Capital Expenditure) for a Lead Smelter and Refinery

Setting up a primary lead manufacturing facility (smelter-refinery) is a large-scale project that involves extremely high capital expenditure (CAPEX).

- Mining and Ore Handling (20-30%, if integrated): This includes mine development, heavy machinery, and the crushing/grinding circuit required to prepare the ore.

- Beneficiation Section (10-15%): Capital for flotation cells, thickeners, and large filter presses to concentrate the lead sulfide ore.

- Smelting and Roasting Section (25-35%): The most capital-intensive part of the plant.

- Sintering/Roasting Machine: A large, high-temperature unit to roast the lead sulfide concentrate, removing sulfur and agglomerating the ore into a sinter.

- Blast Furnace: A massive, refractory-lined furnace where the sinter is reduced to molten lead bullion.

- Gas Handling and Sulfuric Acid Plant: A mandatory and expensive cogeneration facility. The sulfur dioxide (SO2) gas from the roaster must be captured and converted into sulfuric acid (H2SO4), a saleable byproduct.

- Refining Section (10-15%): Large, heated drossing kettles and furnaces for the pyrometallurgical refining of the molten lead to remove impurities like copper, silver, and bismuth.

- Plant Utilities and Support Infrastructure (10-15%): A robust electrical substation, extensive cooling water circuits, and material handling systems (conveyors, cranes).

- Environmental and Safety Systems (5-10%): This includes extensive dust collection systems (baghouses), advanced wastewater treatment plants, and comprehensive systems for monitoring and protecting workers from lead exposure. This is a significant part of the total Lead plant capital cost.

- Casting and Finishing (3-5%): An automated casting wheel and stacking equipment to produce finished lead ingots.

OPEX (Operating Expenses) for a Lead Plant

The ongoing operating expenses (OPEX) of a lead smelter are substantial, directly influencing the cash cost of production.

- Raw Materials and Consumables (40-50% of total OPEX):

- Lead Concentrate/Ore: The cost of the primary feedstock.

- Coke and Fluxes: The cost of metallurgical coke, limestone, and silica for the blast furnace.

- Energy Consumption (25-35%): It includes the vast amount of electricity needed to run motors, pumps, and pollution control equipment, as well as the fuel (natural gas, coke) for the high-temperature furnaces.

- Workforce Compensation (8-12%): Wages and benefits for a skilled workforce of metallurgists, engineers, furnace operators, and maintenance personnel.

- Equipment Maintenance and Repairs (5-7%): High maintenance costs associated with refractory relining, heavy machinery repair, and maintaining the integrity of high-temperature equipment.

- Environmental Compliance and Waste Management (3-5%): Costs for operating the acid plant, managing and disposing of hazardous waste (slag, dust), and continuous environmental monitoring.

Manufacturing Process of Lead

This report comprises a thorough value chain evaluation for Lead manufacturing and consists of an in-depth production cost analysis revolving around industrial Lead manufacturing.

The manufacturing process of lead from its primary ore is a multi-stage pyrometallurgical operation.

- Production via Mining, Crushing, Flotation, Filtering, Roasting, Blasting, Refining, and Casting : Lead production begins with the extraction of galena (PbS) from the earth through drilling and blasting, followed by crushing and grinding the ore into fine powder. The powdered ore undergoes froth flotation, where air bubbles separate lead sulfide from waste rock, producing a lead-rich concentrate. This concentrate is filtered to remove excess water and then roasted or sintered, driving off sulfur as sulfur dioxide (later used to make sulfuric acid) and forming solid sinter lumps. The sinter is smelted in a blast furnace with coke and limestone, where carbon monoxide reduces lead oxides to molten lead. The lead bullion produced is then refined to remove impurities like copper, tin, and silver, yielding up to 99.9% pure lead, which is finally cast into blocks or ingots for shipment.

Properties of Lead

- Chemical Symbol: Pb

- Appearance: A bluish-white, lustrous heavy metal that tarnishes to a dull grey.

- Odour: Odourless.

- Melting Point: 327.5 degree Celsius (621.5 degree Fahrenheit).

- Key Properties: It is very soft, highly malleable, ductile, and has a high density. It is an excellent absorber of radiation (X-rays and gamma rays) and is highly resistant to corrosion.

- Toxicity: Highly toxic. Lead is a cumulative poison that can severely affect the nervous system and other organs. Handling and processing require strict safety protocols.

- Reactivity: It is relatively unreactive and resistant to corrosion from most acids because it forms an insoluble protective layer on its surface.

Lead Manufacturing Plant Report provides you with a detailed assessment of capital investment costs (CAPEX) and operational expenses (OPEX), generally measured as cost per metric ton (USD/MT). This approach ensures that your investment decisions are aligned with the latest industry standards and economic feasibility metrics, enhancing your manufacturing efficiency and financial planning.

Apart from that, this Lead manufacturing plant report also covers the leading technology providers that help you plan a robust plan of action related to Lead manufacturing plant and its production process, and also by helping you with an in-depth supplier database. This report provides exclusive insights into the best manufacturing practices for Lead and technology implementation costs. This report also covers operational cash flow, fixed and variable costs, and detailed break-even point analysis, ensuring that your manufacturing process is not only efficient but also economically viable in the competitive market landscape.

In addition to operational insights, the Lead manufacturing plant report also comprehensively focuses on lifecycle cost analysis, maintenance costs, and energy consumption costs, which are critical for maintaining long-term sustainability and profitability. Our manufacturing cost analysis extends to include regulatory compliance costs, inventory holding costs, and logistics and distribution costs, providing a holistic view of the potential expenses and savings.

We at Procurement Resource ensure that this report is not only cost-efficient, environmentally sustainable, and aligned with the latest technological advancements but also that you are equipped with all necessary tools to optimise supply chain operations, manage risks effectively, and achieve superior market positioning for Lead.

Key Insights and Report Highlights

| Report Features | Details |

|---|---|

| Report Title | Lead Manufacturing Plant Project Report |

| Preface | Overview of the study and its significance. |

| Scope and Methodology | Key Questions Answered, Methodology, Estimations & Assumptions. |

| Executive Summary | Global Market Scenario, Production Cost Summary, Income Projections, Expenditure Projections, Profit Analysis. |

| Global Market Insights | Market Overview, Historical and Forecast (2019-2029), Market Breakup by Segment, Market Breakup by Region, Price Trends (Raw Material Price Trends, Lead Price Trends), Competitive Landscape (Key Players, Profiles of Key Players). |

| Detailed Process Flow | Product Overview, Properties and Applications, Manufacturing Process Flow, Process Details. |

| Project Details | Total Capital Investment, Land and Site Cost, Offsites/Civil Works Cost, Plant Machinery Cost, Auxiliary Equipment Cost, Contingency, Consulting and Engineering Charges, Working Capital. |

| Variable Cost Analysis | Raw Material Specifications, Raw Material Consumption, Raw Material Costs, Utilities Consumption and Costs, Co-product Cost Credit, Labour Requirements and Costs. |

| Fixed Cost Analysis | Plant Repair & Maintenance Cost, Overheads Cost, Insurance Cost, Financing Costs, Depreciation Charges. |

| General Sales and Administration Costs | Costs associated with sales and administration |

| Project Economics | Techno-economic Parameters, Income Projections, Expenditure Projections, Financial Analysis (Payback Period, Net Present Value, Internal Rate of Return), Profit Analysis, Production Cost Summary. |

| Report Format | PDF for BASIC and PREMIUM; PDF+Dynamic Excel for ENTERPRISE. |

| Pricing and Purchase Options | BASIC: USD 2999 PREMIUM: USD 3999 ENTERPRISE: USD 5999 |

| Customization Scope | The report can be customized based on the customer’s requirements. |

| Post-Sale Analyst Support | 10-12 Weeks of support post-sale. |

| Delivery Format | PDF and Excel via email; editable versions (PPT/Word) on special request. |

Key Questions Covered in our Lead Manufacturing Plant Report

- How can the cost of producing Lead be minimised, cash costs reduced, and manufacturing expenses managed efficiently to maximise overall efficiency?

- What is the estimated Lead manufacturing plant cost?

- What are the initial investment and capital expenditure requirements for setting up a Lead manufacturing plant, and how do these investments affect economic feasibility and ROI?

- How do we select and integrate technology providers to optimise the production process of Lead, and what are the associated implementation costs?

- How can operational cash flow be managed, and what strategies are recommended to balance fixed and variable costs during the operational phase of Lead manufacturing?

- How do market price fluctuations impact the profitability and cost per metric ton (USD/MT) for Lead, and what pricing strategy adjustments are necessary?

- What are the lifecycle costs and break-even points for Lead manufacturing, and which production efficiency metrics are critical for success?

- What strategies are in place to optimise the supply chain and manage inventory, ensuring regulatory compliance and minimising energy consumption costs?

- How can labour efficiency be optimised, and what measures are in place to enhance quality control and minimise material waste?

- What are the logistics and distribution costs, what financial and environmental risks are associated with entering new markets, and how can these be mitigated?

- What are the costs and benefits associated with technology upgrades, modernisation, and protecting intellectual property in Lead manufacturing?

- What types of insurance are required, and what are the comprehensive risk mitigation costs for Lead manufacturing?

1 Preface

2 Scope and Methodology

2.1 Key Questions Answered

2.2 Methodology

2.3 Estimations & Assumptions

3 Executive Summary

3.1 Global Market Scenario

3.2 Production Cost Summary

3.3 Income Projections

3.4 Expenditure Projections

3.5 Profit Analysis

4 Global Lead Market

4.1 Market Overview

4.2 Historical and Forecast (2019-2029)

4.3 Market Breakup by Segment

4.4 Market Breakup by Region

4.6 Price Trends

4.6.1 Raw Material Price Trends

4.6.2 Lead Price Trends

4.7 Competitive Landscape

4.8.1 Key Players

4.8.2 Profiles of Key Players

5 Detailed Process Flow

5.1 Product Overview

5.2 Properties and Applications

5.3 Manufacturing Process Flow

5.4 Process Details

6 Project Details, Requirements and Costs Involved

6.1 Total Capital Investment

6.2 Land and Site Cost

6.3 Offsites/ Civil Works Cost

6.4 Plant Machinery Cost

6.5 Auxiliary Equipment Cost

6.6 Contingency, Consulting and Engineering Charges

6.6 Working Capital

7 Variable Cost Analysis

7.1 Raw Materials

7.1.1 Raw Material Specifications

7.1.2 Raw Material Consumption

7.1.3 Raw Material Costs

7.2 Utilities Consumption and Costs

7.3 Co-product Cost Credit

7.4 Labour Requirements and Costs

8 Fixed Cost Analysis

8.1 Plant Repair & Maintanence Cost

8.2 Overheads Cost

8.3 Insurance Cost

8.4 Financing Costs

8.5 Depreciation Charges

9 General Sales and Administration Costs

10 Project Economics

10.1 Techno-economic Parameters

10.2 Income Projections

10.3 Expenditure Projections

10.4 Financial Analysis

10.5 Profit Analysis

10.5.1 Payback Period

10.5.2 Net Present Value

10.5.3 Internal Rate of Return

11 References

Compare & Choose the Right Report Version for You

You can easily get a quote for any Procurement Resource report. Just click here and raise a request. We will get back to you within 24 hours. Alternatively, you can also drop us an email at sales@procurementresource.com.

RIGHT PEOPLE

At Procurement Resource our analysts are selected after they are assessed thoroughly on having required qualities so that they can work effectively and productively and are able to execute projects based on the expectations shared by our clients. Our team is hence, technically exceptional, strategic, pragmatic, well experienced and competent.

RIGHT METHODOLOGY

We understand the cruciality of high-quality assessments that are important for our clients to take timely decisions and plan strategically. We have been continuously upgrading our tools and resources over the past years to become useful partners for our clientele. Our research methods are supported by most recent technology, our trusted and verified databases that are modified as per the needs help us serve our clients effectively every time and puts them ahead of their competitors.

RIGHT PRICE

Our team provides a detailed, high quality and deeply researched evaluations in competitive prices, that are unmatchable, and demonstrates our understanding of our client’s resource composition. These reports support our clientele make important procurement and supply chains choices that further helps them to place themselves ahead of their counterparts. We also offer attractive discounts or rebates on our forth coming reports.

RIGHT SUPPORT

Our vision is to enable our clients with superior quality market assessment and actionable evaluations to assist them with taking timely and right decisions. We are always ready to deliver our clients with maximum results by delivering them with customised suggestions to meet their exact needs within the specified timeline and help them understand the market dynamics in a better way.

SELECT YOUR LICENCE TYPE

- Review the available license options and choose the one that best fits your needs. Different licenses offer varying levels of access and usage rights, so make sure to pick the one that aligns with your requirements.

- If you're unsure which license is right for you, feel free to contact us for assistance.

CLICK 'BUY NOW'

- Once you've selected your desired report and license, click the ‘Buy Now’ button. This will add the report to your cart. You will be directed to the registration page where you’ll provide the necessary information to complete the purchase.

- You’ll have the chance to review your order and make adjustments, including updating your license or quantity, before proceeding to the next step.

COMPLETE REGISTRATION

- Enter your details for registration. This will include your name, email address, and any other necessary information. Creating an account allows you to easily manage your orders and gain access to future purchases or reports.

- If you already have an account with us, simply log in to streamline the process.

CHOOSE YOUR PAYMENT METHOD

- Select from a variety of secure payment options, including credit/debit cards, PayPal, or other available gateways. We ensure that all transactions are encrypted and processed securely.

- After selecting your payment method, you will be redirected to a secure checkout page to complete your transaction.

CONFIRM YOUR PURCHASE

- Once your payment is processed, you will receive an order confirmation email from sales@procurementresource.com confirming the dedicated project manger and delivery timelines.

ACCESS YOUR REPORT

- The report will be delivered to you by the project manager within the specified timeline.

- If you encounter any issues accessing your report, project manager would remain connected throughout the length of the project. The team shall assist you with post purchase analyst support for any queries or concerns from the deliverable (within the remit of the agreed scope of work).

Email Delivery Price: $ 2699.00

Ethyl Acrylate Manufacturing Plant Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Read MoreEmail Delivery Price: $ 2699.00

Hydrotalcite Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Read MoreEmail Delivery Price: $ 2699.00

1-Decene Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Read More