Reports

Liquefied Natural Gas Manufacturing Plant Project Report 2025: Market by Region, Market by Application, Key Players, Pre-feasibility, Capital Investment Costs, Production Cost Analysis, Expenditure Projections, Return on Investment (ROI), Economic Feasibility, CAPEX, OPEX, Plant Machinery Cost

Liquefied Natural Gas Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

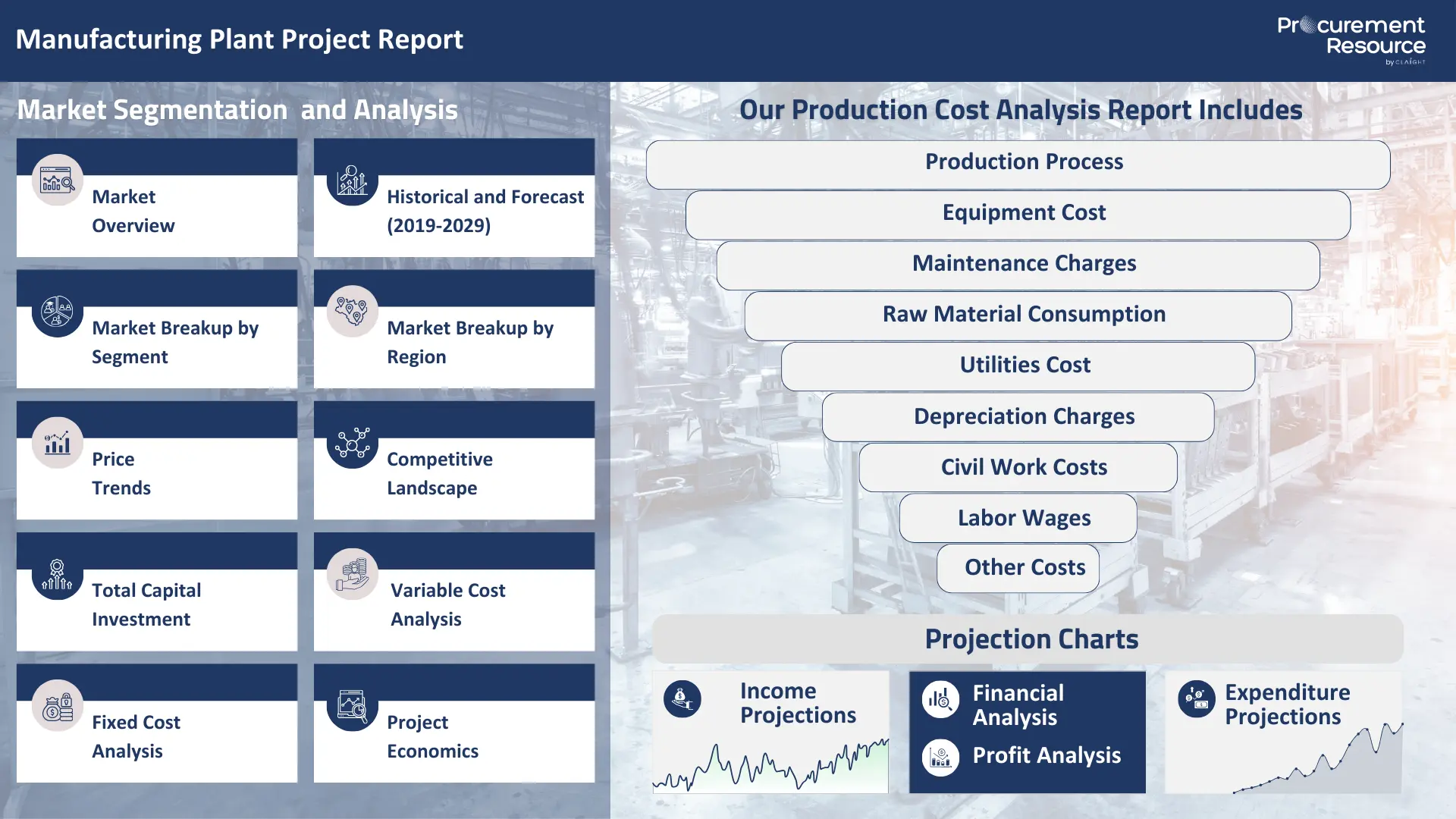

Liquefied Natural Gas Manufacturing Plant Project Report by Procurement Resource thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down Liquefied Natural Gas plant capital cost around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimisation and helps in identifying effective strategies to reduce the overall Liquefied Natural Gas manufacturing plant cost and the cash cost of manufacturing.

Planning to Set Up a Liquefied Natural Gas Plant? Request a Free Sample Project Report Now!

Liquefied Natural Gas (LNG) is natural gas (primarily methane, CH4) that has been converted to a liquid state by cooling it to -162 degree Celsius (-260 degree Fahrenheit) at atmospheric pressure. This cryogenic process reduces the volume of natural gas by about 600 times, which makes it economically feasible to transport large quantities of natural gas over long distances via specialised cryogenic tankers where pipelines are not viable. LNG serves as a crucial bridge fuel in the global energy transition, offering a cleaner-burning alternative to coal and oil for various energy needs.

Industrial Applications of Liquefied Natural Gas (LNG) (Industry-wise Proportion):

- Power Generation (Largest Share): LNG is used as fuel in natural gas-fired power plants. These plants offer lower carbon emissions compared to coal-fired plants, which makes LNG a key component in meeting electricity demand while reducing environmental impact.

- Industrial Fuel: LNG serves as a clean and efficient fuel for a wide range of industrial sectors, including manufacturing, petrochemicals, ceramics, and steel production. Industries transition to LNG to reduce emissions, improve operational efficiency, and meet environmental regulations.

- Residential and Commercial Heating: In regions without pipeline access, regasified LNG can be distributed for heating homes, offices, and other commercial establishments.

- Transportation Fuel (Growing Share): LNG is increasingly used as a fuel for heavy-duty vehicles (trucks), marine vessels (LNG-powered ships), and even some rail applications. Its lower emissions (SOx, NOx, particulate matter, and CO2 compared to diesel/bunker fuel make it an attractive alternative for long-haul transport.

- Feedstock for Petrochemicals: While not its primary direct use, natural gas (from which LNG is derived) is a feedstock for various petrochemicals like ammonia and methanol.

- Peak Shaving and Energy Security: Small-scale LNG facilities are used for peak shaving, storing gas during low-demand periods and regasifying it during high-demand spikes. LNG's flexibility allows rapid response to regional supply shocks, enhancing energy security.

Top 5 Manufacturers of Liquefied Natural Gas (LNG)

The LNG market is dominated by major integrated energy companies involved in natural gas exploration, production, liquefaction, shipping, and regasification. These are often national energy companies or large multinational oil and gas corporations.

- QatarEnergy

- ExxonMobil Corporation

- Shell PLC

- Cheniere Energy, Inc.

- Petronet LNG Ltd.

Feedstock for Liquefied Natural Gas (LNG) and Its Dynamics

The sole raw material for Liquefied Natural Gas (LNG) production is natural gas. The dynamics affecting the supply and price of natural gas are important to any production cost analysis for LNG.

Value Chain and Dynamics Affecting Raw Materials:

- Upstream (Natural Gas Exploration & Production): Natural gas is extracted from conventional gas fields, shale formations (unconventional gas), or as an associated gas from oil production.

- Geological Factors: The cost of extraction varies significantly based on reservoir type, depth, and location (onshore vs. offshore).

- Geopolitical Stability: Production levels and prices are highly sensitive to geopolitical tensions in major gas-producing regions (e.g., Middle East, Russia, USA).

- Drilling Technology: Advances in drilling (e.g., hydraulic fracturing for shale gas) impact supply volumes and extraction costs.

- Midstream (Gas Gathering & Processing): Natural gas is gathered from wells and transported to processing plants where impurities (e.g., water, hydrogen sulfide, carbon dioxide, heavy hydrocarbons like propane and butane) are removed. This ensures the gas meets the specifications for liquefaction.

- Processing Costs: The complexity and cost of removing impurities directly impact the cash cost of production of the purified natural gas.

- Pipeline Infrastructure: The cost and availability of pipeline networks to transport gas from the wellhead to the liquefaction plant are crucial.

- Natural Gas Prices: This is the most significant factor affecting the cash cost of production for LNG. Natural gas prices are highly volatile and influenced by:

- Global Supply and Demand: Driven by economic growth, industrial demand, residential heating needs, and production decisions by major exporters.

- Weather Conditions: Extreme hot or cold weather can spike demand for heating or cooling, leading to price surges.

- Storage Levels: Inventory levels in major consuming regions (e.g., Europe, Asia) influence market sentiment.

- Liquefaction Capacity: The availability of liquefaction capacity (the ability to turn gas into LNG) affects how much natural gas can be converted and supplied to global markets.

- Transportation (In-country): The cost of piping the natural gas from the production field to the liquefaction terminal.

Market Drivers for Liquefied Natural Gas (LNG)

- Energy Security Concerns: Geopolitical events and disruptions to traditional pipeline gas supplies (e.g., in Europe) have significantly heightened the focus on energy security. LNG offers unparalleled flexibility, allowing gas to be transported globally to meet urgent demand and providing a critical buffer against supply shocks.

- Global Energy Transition and Decarbonization Goals: While a fossil fuel, natural gas is considered a bridge fuel in the transition away from more carbon-intensive coal and oil. LNG emits roughly half the CO2 of coal per unit of energy, driving its demand as countries strive to meet decarbonisation targets while ensuring energy reliability.

- Rising Electricity Demand: Rapid industrialisation, urbanisation, and increasing populations, particularly in emerging economies across Asia, are leading to surging electricity needs. LNG-fired power plants are being chosen for their relatively cleaner emissions and quick deployment compared to large coal plants, driving LNG demand.

- Economic Growth and Industrial Expansion: A robust global economy translates into higher industrial output, which requires more energy. Industries increasingly rely on LNG as a clean and efficient fuel to power manufacturing processes, driving its consumption.

- Development of LNG Infrastructure: Investments in new liquefaction terminals (exporters) and regasification terminals (importers), coupled with small-scale LNG distribution networks, enhance the accessibility and flexibility of LNG, further stimulating its demand.

- Geo-locations: Asia-Pacific, mainly Northeast Asia (Japan, South Korea, China) and South Asia (India, Bangladesh, Pakistan), remains the leading and fastest-growing region for LNG consumption. This is due to rising energy demand, increasing environmental regulations (pushing away from coal), and limited domestic gas resources. Europe has also seen a surge in LNG demand to replace Russian pipeline gas. The United States, Australia, and Qatar are the dominant global LNG exporters, driving global supply.

Total Capital Expenditure (CAPEX) for an LNG Plant (Liquefaction Terminal)

- Gas Processing and Pre-treatment Units:

- Inlet Facilities: Receipt of natural gas from pipelines, metering, and initial compression.

- Acid Gas Removal Unit (AGRU): Amine units for removing carbon dioxide (CO2) and hydrogen sulfide (H2S) to prevent freezing in cryogenic sections and meet pipeline specifications.

- Dehydration Unit: Molecular sieves or glycol dehydration for removing water vapour.

- Mercury Removal Unit (MRU): Adsorbent beds to remove mercury, which can cause corrosion in aluminium heat exchangers.

- Heavy Hydrocarbon Removal Unit (NGL Extraction): Cryogenic distillation units to separate heavier hydrocarbons (ethane, propane, butane, C5+) to prevent freezing in the liquefaction process and produce valuable Natural Gas Liquids (NGLs).

- Liquefaction Trains (Core Process Equipment): This is the heart of the plant and the largest portion of the liquefied natural gas plant capital cost (40-50% of midstream costs).

- Cryogenic Heat Exchangers: Brazed aluminium heat exchangers (BAHX) or spiral wound heat exchangers (SWHE) that efficiently transfer heat from the natural gas to various refrigerants, cooling the gas to cryogenic temperatures (-162 degree Celsius).

- Refrigeration Compressors and Turbines: Large-scale, high-power compressors (e.g., driven by gas turbines or electric motors) for circulating the mixed refrigerant streams (e.g., propane, ethylene, methane).

- Refrigerant Storage and Handling Systems: For various refrigerants.

- Cold Boxes: Insulated enclosures housing the cryogenic heat exchangers and associated piping.

- LNG Storage Facilities:

- Cryogenic Storage Tanks: Large, double-walled, insulated tanks made of specialised materials (e.g., 9% nickel steel, concrete outer wall) to safely store LNG at -162 degree Celsius and atmospheric pressure. These are extremely expensive (10-15% of midstream costs).

- Boil-Off Gas (BOG) Compression System: To re-liquefy or re-compress natural gas that vaporises (boil-off) from storage tanks, for re-use as fuel or re-liquefaction.

- Loading and Export Facilities:

- Marine Loading Arms: Specialised cryogenic loading arms to transfer LNG from storage tanks to LNG carriers at marine jetties.

- Jetty and Berth Facilities: Construction of marine terminals, jetties, berthing, and mooring dolphins to accommodate large LNG tankers.

- Metering Systems: High-precision flow metering for custody transfer.

- Utilities and Offsites Infrastructure:

- Power Generation Plant: Integrated gas turbine power plants (or combined cycle gas turbines) are used to provide the massive electrical power required for compressors and other plant operations.

- Cooling Water Systems: Large cooling towers for heat rejection from compression cycles.

- Water Treatment Plant: For process water and boiler feed water.

- Flare System: For safe flaring of excess gases during upsets or shutdowns.

- Effluent Treatment Plant (ETP): For treating any liquid waste streams, ensuring environmental compliance. This contributes to the overall liquefied natural gas manufacturing plant cost.

- Electrical Substation and Distribution: A comprehensive power distribution network.

- Control Room and Automation: Centralised control room with a sophisticated Distributed Control System (DCS) for 24/7 operation and safety.

- Laboratory & Quality Control Equipment: Gas chromatographs, calorimeters, and other advanced analytical instruments for continuous monitoring of natural gas quality and LNG composition.

- Civil Works and Buildings: Extensive land development, heavy-duty foundations, process structures, administrative offices, and workshops.

- Safety and Fire Suppression Systems: Comprehensive fire detection and suppression systems, gas leak detection, emergency shutdown (ESD) systems, and spill containment for cryogenic liquids.

- Indirect Fixed Capital:

- Engineering, Procurement, and Construction (EPC) Costs: Major portion of the total capital expenditure (CAPEX), including detailed design, project management, and construction labour.

- Land Acquisition & Site Preparation: Significant for large coastal facilities.

- Contingency: A substantial allowance (often 15-25% or more) for unforeseen costs and project complexities.

- Permitting and Regulatory Compliance: Extensive and costly environmental impact assessments and permits, critical for such large-scale projects.

- Commissioning and Start-up Costs: Expenses during initial testing and operational ramp-up.

Operating Expenses (OPEX) for an LNG Plant

- Fuel/Energy Costs (Largest Component): This is the largest single component of operating expenses (often 50-70% of total OPEX for liquefaction). The energy required for driving compressors, refrigeration cycles, and other utilities is massive. This includes:

- Natural Gas (as fuel): A significant portion of the incoming natural gas feedstock (around 8-12%) is consumed as fuel to power the liquefaction process itself. Its price volatility directly impacts the cash cost of production.

- Electricity: For auxiliary motors, pumps, lighting, and administrative facilities.

- Operating Labour Costs:

- Salaries, wages, benefits, and training costs for a large, highly skilled workforce of operators, engineers, maintenance technicians, safety personnel, and administrative staff are required for 24/7 continuous operation of a complex LNG terminal.

- Maintenance and Repairs:

- Routine preventative maintenance, scheduled turnarounds (major overhauls), and unscheduled repairs for critical and specialised cryogenic equipment, large compressors, gas turbines, and marine loading facilities.

- Depreciation and Amortisation:

- The non-cash expense of depreciation and amortisation systematically allocates the massive total capital expenditure (CAPEX) over the useful life of the LNG plant's assets (20-30 years).

- Catalyst/Adsorbent/Chemical Consumables:

- Costs for replacement of molecular sieves (for dehydration), amine solvents (for acid gas removal), mercury removal adsorbents, and any other process chemicals.

- Plant Overhead Costs:

- Administrative salaries (plant management, HR, finance), insurance (high for such large assets), local property taxes, security, laboratory consumables, and general plant supplies.

- Environmental Compliance Costs:

- Costs associated with operating and maintaining advanced air pollution control systems (e.g., NOx controls for turbines), wastewater treatment from ETP, waste disposal (e.g., spent adsorbents), and continuous environmental monitoring.

- Port Dues and Terminal Fees: For facilities with marine loading.

- Insurance: Higher premiums due to the scale and inherent risks of LNG operations.

Effective management of these fixed and variable costs, particularly energy consumption and ensuring high plant uptime, is vital for ensuring a competitive cost per metric ton (USD/MT) for LNG.

Manufacturing Process of Liquefied Natural Gas

This report comprises a thorough value chain evaluation for Liquefied Natural Gas (LNG) manufacturing and consists of an in-depth production cost analysis revolving around industrial Liquefied Natural Gas manufacturing.

The industrial manufacturing process of Liquefied Natural Gas (LNG) involves the multi-stage liquefaction of natural gas under stringently controlled conditions. The feedstock for this process is natural gas.

- The process begins with the pre-treatment of natural gas to remove impurities such as water, carbon dioxide, hydrogen sulfide, mercury, and heavier hydrocarbons (like propane and butane). These impurities must be removed to prevent freezing and corrosion in the cryogenic sections of the plant. After purification, the natural gas enters the liquefaction section, the core of the process. The natural gas is progressively cooled to extremely low temperatures, below its boiling point of around -162 degree Celsius, using a series of refrigeration cycles. Large compressors drive refrigerant gases (often a mixed refrigerant) through heat exchangers, gradually drawing heat out of the natural gas stream. As the temperature drops below its boiling point, natural gas changes from a gaseous state to a liquid state, significantly reducing its volume. The resulting Liquefied Natural Gas (LNG) is then stored in large, insulated cryogenic tanks at atmospheric pressure, ready for transportation.

Properties of Liquefied Natural Gas

- Physical State: Clear, colourless liquid.

- Odour: Odourless (pure LNG); sometimes contains a mild odorant (like mercaptans) for leak detection upon regasification, but not in its liquid state.

- Main Component: Primarily Methane (CH4), over 90% by volume.

- Boiling Point: -162 degree Celsius (-260 degree Fahrenheit) at atmospheric pressure.

- Density: Very low, approximately 0.42-0.50 kg/L (less than half the density of water), making it float on water.

- Volume Reduction: Natural gas volume is reduced about 600 times when liquefied.

- Non-corrosive: Does not corrode metals commonly used in pipelines and storage tanks.

- Non-toxic: In its pure form, it is non-toxic. However, large releases can displace oxygen, creating an asphyxiation hazard.

- Flammability: Highly flammable upon regasification and mixing with air (within a narrow range of 5-15% natural gas in air). LNG liquid itself does not ignite unless vaporised and mixed with air.

- Cryogenic Hazard: Contact with LNG liquid can cause severe frostbite due to its extremely low temperature.

- Specific Energy: High energy content per unit mass (50-55 MJ/kg).

- Storage: Stored at atmospheric pressure in specialised cryogenic tanks, unlike compressed natural gas (CNG).

Liquefied Natural Gas Manufacturing Plant Report provides you with a detailed assessment of capital investment costs (CAPEX) and operational expenses (OPEX), generally measured as cost per metric ton (USD/MT). This approach ensures that your investment decisions are aligned with the latest industry standards and economic feasibility metrics, enhancing your manufacturing efficiency and financial planning.

Apart from that, this Liquefied Natural Gas manufacturing plant report also covers the leading technology providers that help you plan a robust plan of action related to Liquefied Natural Gas manufacturing plant and its production process, and also by helping you with an in-depth supplier database. This report provides exclusive insights into the best manufacturing practices for Liquefied Natural Gas and technology implementation costs. This report also covers operational cash flow, fixed and variable costs, and detailed break-even point analysis, ensuring that your manufacturing process is not only efficient but also economically viable in the competitive market landscape.

In addition to operational insights, the Liquefied Natural Gas manufacturing plant report also comprehensively focuses on lifecycle cost analysis, maintenance costs, and energy consumption costs, which are critical for maintaining long-term sustainability and profitability. Our manufacturing cost analysis extends to include regulatory compliance costs, inventory holding costs, and logistics and distribution costs, providing a holistic view of the potential expenses and savings.

We at Procurement Resource ensure that this report is not only cost-efficient, environmentally sustainable, and aligned with the latest technological advancements but also that you are equipped with all necessary tools to optimise supply chain operations, manage risks effectively, and achieve superior market positioning for Liquefied Natural Gas.

Key Insights and Report Highlights

| Report Features | Details |

|---|---|

| Report Title | Liquefied Natural Gas Manufacturing Plant Project Report |

| Preface | Overview of the study and its significance. |

| Scope and Methodology | Key Questions Answered, Methodology, Estimations & Assumptions. |

| Executive Summary | Global Market Scenario, Production Cost Summary, Income Projections, Expenditure Projections, Profit Analysis. |

| Global Market Insights | Market Overview, Historical and Forecast (2019-2029), Market Breakup by Segment, Market Breakup by Region, Price Trends (Raw Material Price Trends, Liquefied Natural Gas Price Trends, Competitive Landscape (Key Players, Profiles of Key Players). |

| Detailed Process Flow | Product Overview, Properties and Applications, Manufacturing Process Flow, Process Details. |

| Project Details | Total Capital Investment, Land and Site Cost, Offsites/Civil Works Cost, Plant Machinery Cost, Auxiliary Equipment Cost, Contingency, Consulting and Engineering Charges, Working Capital. |

| Variable Cost Analysis | Raw Material Specifications, Raw Material Consumption, Raw Material Costs, Utilities Consumption and Costs, Co-product Cost Credit, Labour Requirements and Costs. |

| Fixed Cost Analysis | Plant Repair & Maintenance Cost, Overheads Cost, Insurance Cost, Financing Costs, Depreciation Charges. |

| General Sales and Administration Costs | Costs associated with sales and administration |

| Project Economics | Techno-economic Parameters, Income Projections, Expenditure Projections, Financial Analysis (Payback Period, Net Present Value, Internal Rate of Return), Profit Analysis, Production Cost Summary. |

| Report Format | PDF for BASIC and PREMIUM; PDF+Dynamic Excel for ENTERPRISE. |

| Pricing and Purchase Options | BASIC: USD 2999 PREMIUM: USD 3999 ENTERPRISE: USD 5999 |

| Customization Scope | The report can be customized based on the customer’s requirements. |

| Post-Sale Analyst Support | 10-12 Weeks of support post-sale. |

| Delivery Format | PDF and Excel via email; editable versions (PPT/Word) on special request. |

Key Questions Covered in our Liquefied Natural Gas Manufacturing Plant Report

- How can the cost of producing Liquefied Natural Gas be minimised, cash costs reduced, and manufacturing expenses managed efficiently to maximise overall efficiency?

- What is the estimated Liquefied Natural Gas manufacturing plant cost?

- What are the initial investment and capital expenditure requirements for setting up a Liquefied Natural Gas manufacturing plant, and how do these investments affect economic feasibility and ROI?

- How do we select and integrate technology providers to optimise the production process of Liquefied Natural Gas, and what are the associated implementation costs?

- How can operational cash flow be managed, and what strategies are recommended to balance fixed and variable costs during the operational phase of Liquefied Natural Gas manufacturing?

- How do market price fluctuations impact the profitability and cost per metric ton (USD/MT) for Liquefied Natural Gas, and what pricing strategy adjustments are necessary?

- What are the lifecycle costs and break-even points for Liquefied Natural Gas manufacturing, and which production efficiency metrics are critical for success?

- What strategies are in place to optimise the supply chain and manage inventory, ensuring regulatory compliance and minimising energy consumption costs?

- How can labour efficiency be optimised, and what measures are in place to enhance quality control and minimise material waste?

- What are the logistics and distribution costs, what financial and environmental risks are associated with entering new markets, and how can these be mitigated?

- What are the costs and benefits associated with technology upgrades, modernisation, and protecting intellectual property in Liquefied Natural Gas manufacturing?

- What types of insurance are required, and what are the comprehensive risk mitigation costs for Liquefied Natural Gas manufacturing?

1 Preface

2 Scope and Methodology

2.1 Key Questions Answered

2.2 Methodology

2.3 Estimations & Assumptions

3 Executive Summary

3.1 Global Market Scenario

3.2 Production Cost Summary

3.3 Income Projections

3.4 Expenditure Projections

3.5 Profit Analysis

4 Global Liquefied Natural Gas Market

4.1 Market Overview

4.2 Historical and Forecast (2019-2029)

4.3 Market Breakup by Segment

4.4 Market Breakup by Region

4.6 Price Trends

4.6.1 Raw Material Price Trends

4.6.2 Liquefied Natural Gas Price Trends

4.7 Competitive Landscape

4.8.1 Key Players

4.8.2 Profiles of Key Players

5 Detailed Process Flow

5.1 Product Overview

5.2 Properties and Applications

5.3 Manufacturing Process Flow

5.4 Process Details

6 Project Details, Requirements and Costs Involved

6.1 Total Capital Investment

6.2 Land and Site Cost

6.3 Offsites/ Civil Works Cost

6.4 Plant Machinery Cost

6.5 Auxiliary Equipment Cost

6.6 Contingency, Consulting and Engineering Charges

6.6 Working Capital

7 Variable Cost Analysis

7.1 Raw Materials

7.1.1 Raw Material Specifications

7.1.2 Raw Material Consumption

7.1.3 Raw Material Costs

7.2 Utilities Consumption and Costs

7.3 Co-product Cost Credit

7.4 Labour Requirements and Costs

8 Fixed Cost Analysis

8.1 Plant Repair & Maintanence Cost

8.2 Overheads Cost

8.3 Insurance Cost

8.4 Financing Costs

8.5 Depreciation Charges

9 General Sales and Administration Costs

10 Project Economics

10.1 Techno-economic Parameters

10.2 Income Projections

10.3 Expenditure Projections

10.4 Financial Analysis

10.5 Profit Analysis

10.5.1 Payback Period

10.5.2 Net Present Value

10.5.3 Internal Rate of Return

11 References

Compare & Choose the Right Report Version for You

RIGHT PEOPLE

At Procurement Resource our analysts are selected after they are assessed thoroughly on having required qualities so that they can work effectively and productively and are able to execute projects based on the expectations shared by our clients. Our team is hence, technically exceptional, strategic, pragmatic, well experienced and competent.

RIGHT METHODOLOGY

We understand the cruciality of high-quality assessments that are important for our clients to take timely decisions and plan strategically. We have been continuously upgrading our tools and resources over the past years to become useful partners for our clientele. Our research methods are supported by most recent technology, our trusted and verified databases that are modified as per the needs help us serve our clients effectively every time and puts them ahead of their competitors.

RIGHT PRICE

Our team provides a detailed, high quality and deeply researched evaluations in competitive prices, that are unmatchable, and demonstrates our understanding of our client’s resource composition. These reports support our clientele make important procurement and supply chains choices that further helps them to place themselves ahead of their counterparts. We also offer attractive discounts or rebates on our forth coming reports.

RIGHT SUPPORT

Our vision is to enable our clients with superior quality market assessment and actionable evaluations to assist them with taking timely and right decisions. We are always ready to deliver our clients with maximum results by delivering them with customised suggestions to meet their exact needs within the specified timeline and help them understand the market dynamics in a better way.

Ethyl Acrylate Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

Ethyl Acrylate Manufacturing Plant Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

Hydrotalcite Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

Hydrotalcite Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.

1-Decene Manufacturing Plant Project Report 2025: Cost Analysis, ROI, and Feasibility Insights

1-Decene Manufacturing Plant Project Report thoroughly focuses on every detail that encompasses the cost of manufacturing. Our extensive cost model meticulously covers breaking down expenses around raw materials, labour, technology, and manufacturing expenses. This enables precise cost structure optimization and helps in identifying effective strategies to reduce the overall cash cost of manufacturing.